stock option tax calculator ireland

The Income Tax IT and Universal Social Charge USC due on the exercise of a share option is known as Relevant Tax on Share Options RTSO. This is when the employee sells the shares.

Ireland Cryptocurrency Tax Guide 2021 Koinly

Assuming the 40 tax rate applies the tax on the share options is 8000.

. The Global Tax Guide explains the taxation of equity awards in 43 countries. This article focuses on share options which have a vesting period of 7 years or less. The value of the benefit is the market value of the shares at the date they were awarded.

To complete the Stocking Rate calculator you will need the following information. We do our best to keep the writing lively. On this page is an Incentive Stock Options or ISO calculator.

Click Here to download your RTSO1 Form from Revenue. Abbreviated Model_Option Exercise_v1 - Pagos. The taxation in Ireland is usually done at the source through a pay-as-you-earn.

Employees have always welcomed share schemes as they allow the employee to participate financially and in some instances tax efficiently in the growth of their employers share price. The Ireland Capital Gains Tax Calculator is designed to allow free online calculations for residents and non-residents who have accrued income from capital gains in Ireland. The taxation in Ireland is usually done at the source through a pay-as-you-earn.

This calculator illustrates the tax benefits of exercising your stock options before IPO. USC is tax payable on an individuals total income. You must pay IT and USC at the higher rate.

And 8 of any remaining balance. Please enter your option information below to see your potential savings. The grant of an iso or other statutory stock option does not produce any immediate income subject to regular income taxes.

Capital Gains Tax on RSUs and Non-Doms. This is when the employee purchases the option. Stock options restricted stock restricted stock units performance shares stock.

How to calculate and pay Relevant Tax on Share Options Rate of tax. This paper profit is immediately liable for income tax and must be paid over to the revenue within 30 days of exercising the option. Stock option tax calculator ireland.

This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France. When the option is exercisedgranted. Income Tax rates are currently 20 and 40.

EToro income will also be subject to Universal Social Charge USC. The country profiles are regularly reviewed and updated as needed. A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company.

How to Reduce CGT on Sales of Shares in Ireland. The Stocking Rate calculator can be used to calculate stocking rates in terms of Livestock Unit and Kgs of Organic Nitrogen per Hectare. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net proceeds.

It can also show your worst-case AMT owed upfront total tax and its breakdown and the allocation of income depending on your exercise. We summarise below the main tax issues to consider. There are 2 tax.

From 2011 onwards PRSI 4 and the USC 8 charges also apply. 45 of the next 50672. Stock options restricted stock restricted stock units performance shares stock appreciation rights and employee stock purchase plans.

There are 2 tax activities with stock options. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. The problem is that there is literally no information in the Internet about how this activity would be taxed in Ireland.

These shares are a benefit in kind BIK. The Revenue form RTSO1 is used for the purpose of making a Relevant Tax on a Share Option payment. You must also pay Pay Related Social Insurance PRSI using the rate of the PRSI Class applied to you for the tax year.

If you have been granted share options and the entire or a portion of the vesting period relates to a period where you were working in Ireland an Irish tax liability will arise. If you have shares that have increased in value you can sell a sufficient number of shares each tax year to give a gain of 1270 which is equal to the. A single share of the stock represents fractional ownership of the corporation in proportion to the total number of shares.

When the option is sold. The Ireland Capital Gains Tax Calculator is designed to allow free online calculations for residents and non-residents who have accrued income from capital gains in Ireland. Potentially a Non-Dom could only pay CGT on proceeds from an RSU disposal that they remit into Ireland.

Any income tax due on the exercise of the option is chargeable under self-assessment. Hi everyone Im interested in starting to trade US stock options contracts. Marginal tax rates.

Stock option tax calculator ireland. A short option no charge to income tax arises on the date that the right is granted. Abbreviated Model_Option Exercise_v1 -.

Any gains you make is either taxed as a Capital Gain 33 CGT or as income where you can pay up to 52 of tax. - no income tax USC or PRSI. Expected livestock numbers and age per month in 2022.

This gives the total tax bill of 10400. So to reduce or avoid some Capital Gains Tax it is possible to do the following. The Ireland Capital Gains Tax Calculator is designed to allow free online calculations for residents and non-residents who have accrued income from capital gains in Ireland.

There is a tax saving of employer PRSI at 1095 for the employer where remuneration is by way of equity participation when compared to cash or other benefits. Standard rates for USC for 2019 are 05 of the first 12012. 2 of the next 7862 2.

Assuming the 40 tax rate applies the tax on the share options is 8000. The Revenue website explains how the Capital Gains Tax works 33 for Irish and 40 for foreign properties if I understood correctly. In most cases the RSUs are held in a brokerage account outside Ireland.

In essence this means that the money is outside Ireland and if you are a Non-Dom then it is not taxable here. The annual tax-free CGT exemption of 1270 cannot be carried forward from year to year. The stock also capital stock of a corporation is constituted of the equity stock of its owners.

The calculator allows quick capital gains tax calculations and more detailed capital gains tax calculations with multiple line items so that you can calculate the total tax. Total area in grassland and tillage you will farm in 2022. Stock option tax calculator ireland.

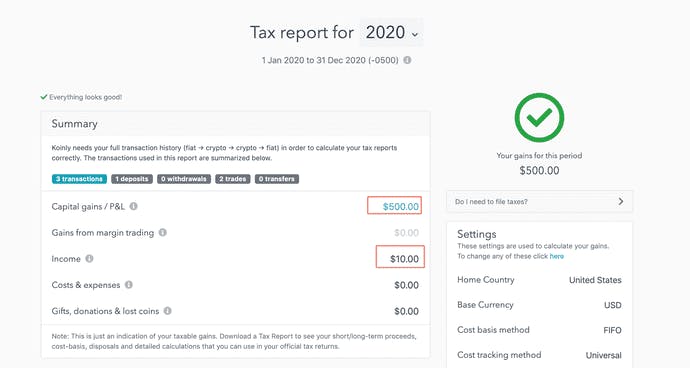

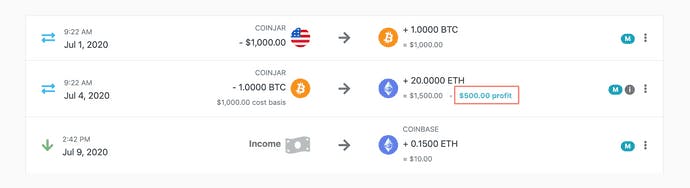

Ireland Cryptocurrency Tax Guide 2021 Koinly

Ireland Cryptocurrency Tax Guide 2021 Koinly

Automate Payroll Tax Calculation Vertex Inc

Is 65000 Euros Year Gross A Good Salary For Living In Dublin Ireland Could We Obtain A Decent Lifestyle For A Family Of Three 2 Adults And Baby Quora

Automate Payroll Tax Calculation Vertex Inc

Capital Gains Tax Ireland Calculating Paying Filing Cgt In Ireland Youtube

Ireland Cryptocurrency Tax Guide 2021 Koinly

Capital Gains Tax What Is It When Do You Pay It

Top 10 Crypto Tax Free Countries 2022 Koinly

How To Calculate Net Operating Loss A Step By Step Guide

Capital Gains Tax Ireland Calculating Paying Filing Cgt In Ireland Youtube

5 Things To Know About The Chime Credit Builder Visa Secured Credit Card Forbes Advisor

H R Block Review 2022 Pros And Cons

Tax Calculator Excel Spreadsheet Youtube

Ireland Cryptocurrency Tax Guide 2021 Koinly

Ireland Cryptocurrency Tax Guide 2021 Koinly

Capital Gains Tax Ireland Calculating Paying Filing Cgt In Ireland Youtube

Getting To Know Gilti A Guide For American Expat Entrepreneurs